From today & for decades to come, how the home is built & what it is built of will need to adapt to changes in regulation, technology, energy sources & costs, and consumer preferences. Making buildings more energy efficient will contribute significantly to the EU achieving its energy and climate goals as buildings are responsible for approximately 40% of the EU energy consumption. This creates a major opportunity for listed players in the space of 1/Heating, ventilation, and air conditioning 2/ Energy management 3/ Alternative building products.

THE GROWING DESIRE FOR ENERGY EFFICIENCY

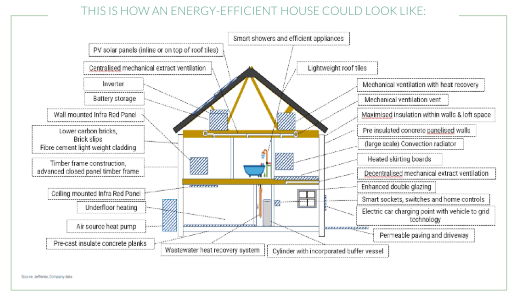

The construction and renovation sector will need to adapt and embrace the growing desire and regulation for energy efficiency. On the product side, practicalities of costs, installation and customer use are key factors for producers/suppliers of product to look out for if they want to participate and seize the opportunity the sector is going through. On July 2023, the EU officially concluded the legislative process to strengthen the Energy Efficiency directive which sets the target for consuming 11.7% less energy to the projected use for 2030 based on the 2020 reference scenario. Energy efficiency in buildings will be achieved especially in these 3 areas :

HEATING, VENTILATION AND AIR CONDITIONING (HVAC)

Key in future homes will be the move away from fossil fuels heating. With hydrogen at this time, only appearing a viable fuel for homes where there is a near and ready access, it appears air source heat pumps will be the primary heating mechanism for single family home through the coming 10 years. With air source heat pumps providing a low temperature heating system (35-45 degrees C for heating and 55 degree C for hot water vs. 60-65 degrees C for a traditional boiler), other heating accessories in the home are also needed such as electric towel rails. As regulators look for ways to reduce energy consumption, heating and cooling, which represents 50% of all energy consumed, are going to be a key area of energy efficiency improvement. 10 million additional heat pumps are to be installed by 2027 in the RePowerEU plan. National legislators are pushing as well with Germany approving a new heating law saying that all new heating systems need to be powered by at least 65% of renewable energy. The new law will reduce the CO2 emissions by 40 million tones by 2030. Numbers of requests for subsidies of heat pumps were 48 804 in H1 2023 (vs 97 766 in H1 2022) and should normalize going forward, now that uncertainty around the heating law is settled.

Players like LU-VE or SYSTEMAIR are well positioned to benefit from this trend. LU-VE designs and manufactures refrigeration and air conditioning products and is therefore well-positioned to profit from the transition to natural refrigerator and energy efficient solution in the refrigerator/HVAC segment. Similarly, to LU-VE, SYSTEMAIR is a global player focused on providing comprehensive solution in the ventilation industry. The company offers a wide range of products for a variety of applications such as air handling units, fans, air distribution, airborne heating etc. With increased legislative measures that are aimed at energy-efficiency in buildings and increasing general awareness of the need for appropriate indoor quality SYSTEMAIR will be a key player within this growing market.

ENERGY MANAGEMENT

BARRATT DEVELOPMENTS, a building and properties developer, indicates the step up in electricity usage as heating becomes electrified could drive a doubling of the electricity consumption of an average home (from 8KW/day to 12-15KW/day). While there is discussion about the requirement for upgrading the grid networks to homes to accommodate this additional energy requirement, it appears that use of PV panels, batteries, and potentially electric vehicle to grid EV chargers may be sufficient to provide 50-90% of the electricity requirement. PV panels alone (with 16-20 panels on the roof) is estimated to be able to generate 7KW/day (if all energy generated can be used or stored and used) which would be able to cover 53% of the annual energy usage of a 2.5 people home. MEYER BURGER is the only cell and module manufacturer in Europe using next generation technology namely HJT (High Junction Technology). It offers a premium product with higher efficiency as well as lower degradation at an attractive price point.

Important in this will also be the usage of smart sockets, switches and home controls to ensure electricity is used efficiently. At a more basic level these can optimize heating, lighting, security, to the use of AI to learn consumption profiles of the home combined with the weather forecasts and grid tariff information to select the best operating schedules for each device to minimize the bills. Energy management sales are projected to grow at a CAGR of 19% to 2027. In 2022 they amounted to $9bn (Source: Statista). Profiting from this trend is the Dutch company ALFEN who offers charging equipment as well as Smart Grid solutions. They also focus on energy storage systems and are working on offering more and more integrated solutions.

ALTERNATIVE BUILD PRODUCTS

While the reduced carbon emissions and embedded carbon from housing is driving significant changes in heating and ventilation, there are also changes in materials which we believe will occur. There may also be a change in how building is done, with the increased focus on off-site manufacturing. With focus on reducing carbon emission there has been a step up in insulation requirements in the past years with more limited changes in the few years from new builds. The EU Energy Performance of Buildings Directive (EPBD) and the Energy Efficient Directive (EED) provide a framework for more energy and resource efficiency in the building sector. Requirements are not only for new buildings but also for existing buildings. Particularly in times when rapid implementation of climate protection targets is required in the context of apparent climate change and higher temperatures, thermal insulation can be a game changer. STEICO, an energy saving, wood-based and ecological insulating material manufacturer offers a wide range of solutions for the roof, floors, andwalls for both new construction as well as for renovation projects.

Discover the full Fund Insight of ODDO BHF AM here.